23 Feb 2023

【財政預算案2023】財爺減首置印花稅

[Financial Budget 2023] The Financial Secretary reduces the stamp duty on the first purchase

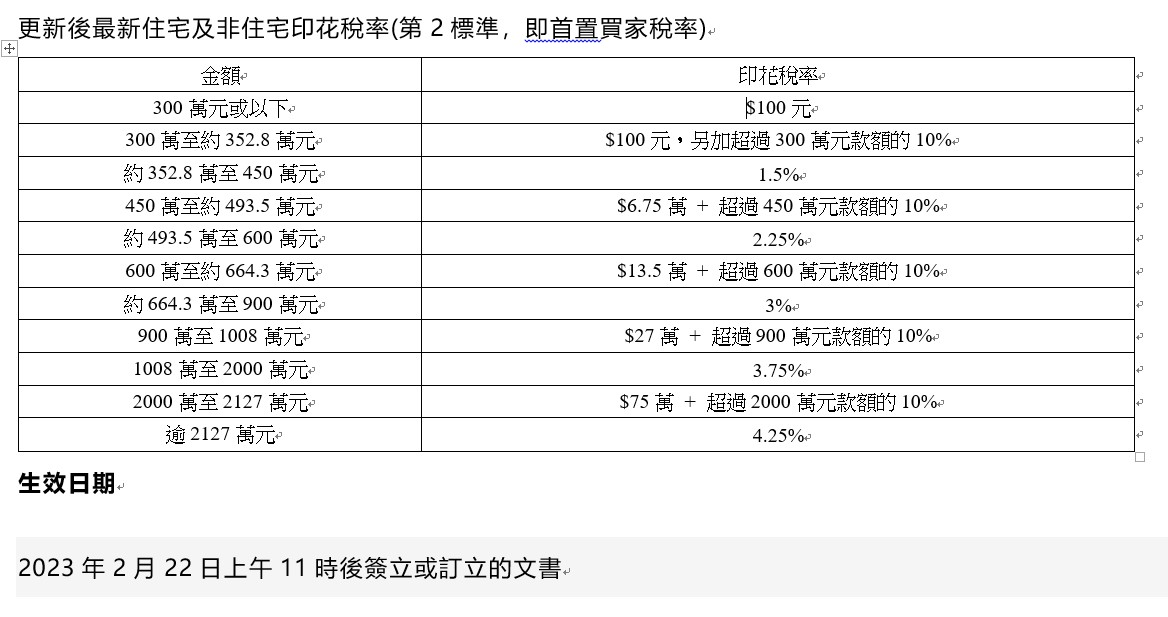

財政司司長陳茂波在2023/24年度財政預算案,公布調整2010年以來未有調整的住宅印花稅,將稅階擴闊,當中屬於$100元象徵印花稅的門檻由200萬元放寬至300萬元,一眾納米樓、細價樓將會受惠,印花稅將大減99.8%。

生效日期

2023年2月22日上午11時後簽立或訂立的文書

若果以300萬元的樓價計算,現時印花稅率為1.5%,亦即是4.5萬元,不過在調整後的新稅階,將會大幅降低至100元,大減4.49萬元或99.8%。據資料顯示,現時300萬元以下二手放盤大約有490個,佔整體放盤量約1.1%。

至於樓價900萬元的物業,按照原有印花稅率為3.75%,相當於33.75萬元稅款,而調整後將會降低至3%,即稅款約27萬元,將舊稅率減稅6.75萬元或20%。

Financial Secretary Paul Chan Mo-po announced in the 2023/24 budget that the residential stamp duty that has not been adjusted since 2010 will be adjusted, and the tax band will be widened. A large number of nano-sized properties and small-priced properties will benefit, and the stamp duty will be greatly reduced by 99.8%.

effective date

Instruments executed or made after 11:00 am on February 22, 2023

If the property price of 3 million is calculated, the current stamp duty rate is 1.5%, which is 45,000. However, after the adjustment, the new tax band will be greatly reduced to 100, a big reduction of 44,900 or 99.8%. . According to statistics, there are currently about 490 second-hand listings below 3 million, accounting for about 1.1% of the total listings.

As for properties with a property price of 9 million, the original stamp duty rate is 3.75%, which is equivalent to a tax of 337,500. After adjustment, it will be reduced to 3%, that is, the tax will be about 270,000, and the old tax rate will be reduced by 67.5 thousand dollars or 20%.